A major objective of the Belt and Road Initiative (BRI) is to reduce the time and cost it takes to transport goods and people across BRI economies. Many of these countries face serious gaps in infrastructure, especially related to trade and investment.

Traveling on a rural highway in Kazakhstan. PhotoCredit: Kubat Sydykov / World Bank

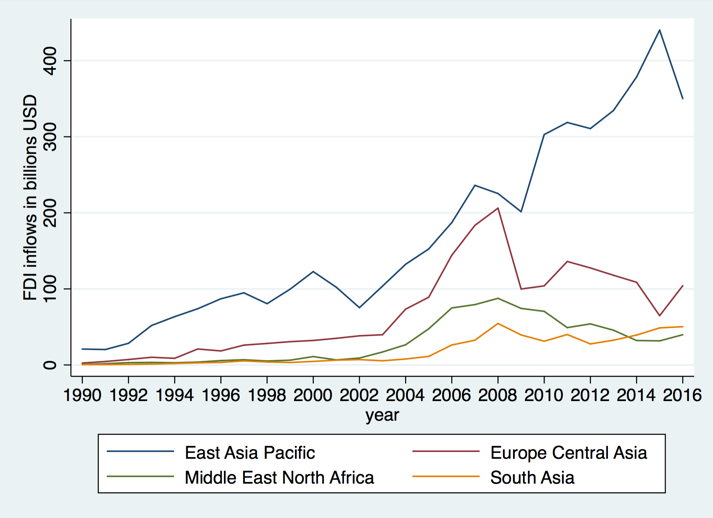

Over the last decades, foreign direct investment (FDI) in BRI economies has risen significantly. This rise in FDI inflow has come from a variety of regions, in particular, East Asia Pacific. China alone now accounts for 20% of the total FDI inflows in BRI economies. However, new research by Chen and Lin (2018) shows that there is still potential for further growth.

Fig 1. FDI Trends in BRI Economies

The new research posed the question, “Could an improved transportation network encourage more investment and subsequently economic growth?”

The answer is positive - the proposed BRI transportation network, by reducing overall travel times and transportation costs, can pave the way for additional investments and increased GDP growth, but the magnitude of the effect varies significantly across source and destination countries.

The research highlights three important findings:

-

Reduced travel time helps boost investment. The newly proposed transportation network could lead to a reduction in travel time of 0.69 day, or 3.2%. This reduction in time – and by extension transportation cost - could result in a 4.97% increase in total FDI inflows to BRI countries. The positive effects on FDI from reducing transportation time and cost can be particularly strong for FDI from non-BRI countries (5.75%) and destination regions such as Sub-Saharan Africa (7.47%), East Asia Pacific (6.25%) and South Asia (5.19%). The effects can also be magnified when accompanied by improvements in the business regulatory environment.

-

Investment breeds more investment. There is a significant correlation between construction projects by Chinese firms in other BRI countries and increased direct investment. According to the analysis, a 10% increase in China’s construction activities is associated with an increase in outward FDI from China by 7% in the same year, 11% the next year, and 16% in two years. This suggests that China’s infrastructure activities overseas may serve as a catalyst for Chinese investments in manufacturing or services.

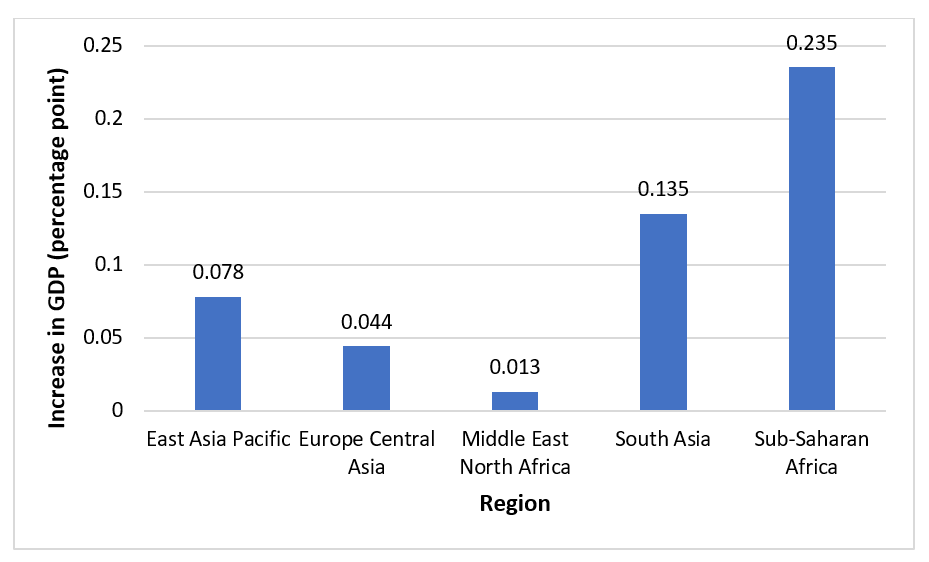

- More FDI is linked with GDP increase. The increase in FDI resulting from reducing transportation costs can have a positive effect on GDP, trade, and employment growth, especially for lower-income countries. The research found that the proposed BRI transportation network and the resulting increases in FDI can increase BRI countries’ GDP growth by 0.09 percentage point. These positive effects vary by region and range from 0.01 percentage point in Middle East & North Africa to 0.23 percentage point in Sub-Saharan Africa. BRI can also stimulate growth in non-BRI countries through a transportation network effect by, for example, raising non-BRI Sub-Saharan countries’ GDP growth by 0.13 percentage point.

Figure 2: The estimated effects of the BRI transportation network on GDP growth by BRI region

The findings suggest that initiatives aiming to improve physical infrastructure should take into account the differences in the expected returns across projects and geographic areas. The positive effects of infrastructure investment can be magnified when accompanied with an improvement in business environment. The BRI transportation network can also stimulate growth in non-BRI countries in the same region through a network spillover effect.