Two years after closing down its domestic e-commerce business, Amazon is reminding China it’s still open for cross-border business.

The world’s largest e-commerce platform is joining a major event dedicated to promoting imports for the first time. The company staged an exhibit at the government-initiated China International Import Expo (CIIE), focusing on its cross-border e-commerce platform, the Amazon Global Store. The fourth annual CIIE kicked off Friday.

“Through our first exhibit at CIIE ... [we] hope to seize a share of the opportunity of the Chinese market and benefit Chinese users,” said a company statement.

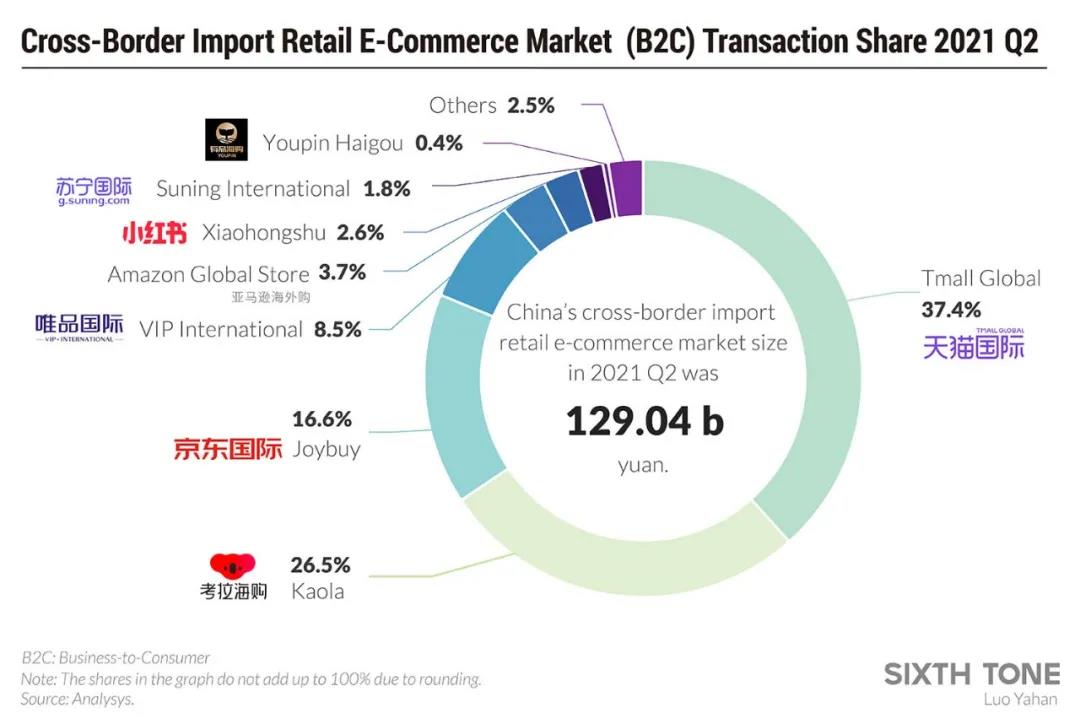

Cross-border e-commerce has become a major market since its emergence in China in the early 2010s, reaching 129 billion yuan ($20 billion) in Q2 of 2021, according to a report by market research firm Analysys. Tech giants including Alibaba, JD.com, and Netease have all launched services to allow Chinese consumers to shop directly from overseas.

Amazon's Li Yanchuan, head of China Global Store and Prime, wrote in a separate statement that the cross-border e-commerce platform has Chinese roots: “The Amazon Global Store was first launched for China … it has met the needs of Chinese consumers for authentic overseas goods, creative services, and consumption upgrades.” The Amazon Global Store was launched in 2014 by Amazon China and has since been rolled out in other countries such as the U.K., Australia, Mexico, and South Korea.

Through the platform, Chinese consumers have access to over 32 million products across 35 product categories, including apparel, footwear, beauty, toys, and personal care from Amazon’s U.S., U.K., Japan, and German sites, according to the company.

Amazon shut down its Chinese domestic shopping business in July 2019 but has kept a presence in China with the Amazon Global Store, cloud computing, Kindle e-readers, and services for Chinese brands that sell to other markets.

Amazon does not disclose its sales in China, aggregating them into “rest of the world” in its 2020 annual report. The smallest market for which Amazon reports sales is Japan, which accounted for 5.2% of Amazon’s global business last year.

The renewed push comes as Amazon is kicking many suspect Chinese sellers off its global stores in an effort to clean up the marketplace. Around 50,000 Chinese sellers have reportedly been banned due to practices such as pay-for-praise or posting computer-generated reviews.

In terms of market share, China’s cross-border e-commerce market is dominated by major Chinese e-commerce companies. The top three cross-border platforms include Tmall Global and Koala, both run by Alibaba, and JD.com’s JoyBuy, together accounting for over 80% of the market share, according to Analysys. The Amazon Global Store only holds 3.7%.

Domestic companies such as Tmall Global and JoyBuy benefit from their products appearing in search results in their owners’ popular shopping apps, giving them direct access to the platforms’ hundreds of millions of regular customers.

Amazon’s cross-border trade marketplace may still have some catching up to do. Miro Li, the founder of Shenzhen-based branding and marketing consultancy Double V, said it might have a difficult time appealing to 20-something young consumers. Its main audience is likely to be “loyal Amazon Prime members or veteran cross-border consumers who trust Amazon products.”

Meanwhile, she said that the platform also faces another strong but often overlooked competitor: the daigou, or substitute shopper, trade. Despite tightened regulations ,the once gray-market practice of individuals bringing overseas goods to sell in China is a multi-billion-dollar industry.

“Many daigou businesses that first made it on Taobao have moved over to [messenger platform] WeChat. Many of them deliver directly from overseas or from customs bonded warehouses, and they take a large slice of the market,” she added. “But it’s hard to monitor these sales.”