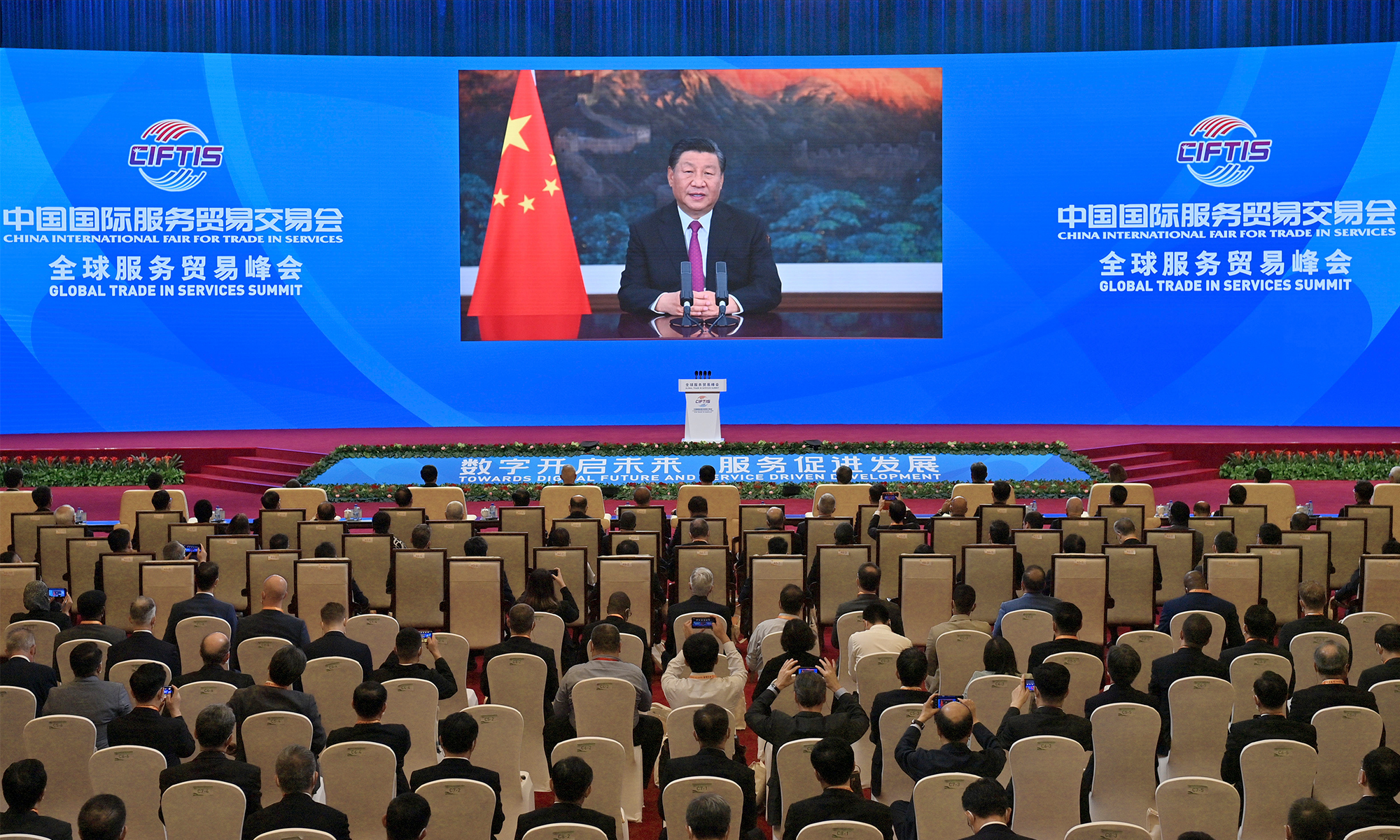

Chinese President Xi Jinping addresses the Global Trade in Services Summit of the 2021 China International Fair for Trade in Services via video on Thursday. Photo: Xinhua

China on Thursday pledged bigger and bolder efforts to open up its market for the services trade and expand the country's role as a global services hub with the top leader's announcement that a new stock exchange in Beijing and more digital trade pilot zones would be established, as it kicked off a major trade fair in Beijing that attracted widespread global participation. The latest move sent an unmistakable signal that Beijing will stick to its opening-up policies and sustainable development goals and support a global economy ravaged by protectionism and the COVID-19 pandemic.The opening of the 2021 China International Fair for Trade in Services (CIFTIS) also illustrated China's early recovery from the COVID-19 pandemic and its robust services industry, especially in digital trade, a bourgeoning part of the services trade. The fresh pledge from the top leader also helps dispel growing concerns and even criticism of China's recent regulatory actions. A paradigm focus on trade in services will also encourage China's major services trading partners, particularly the US, to rethink their China trade policies, observers said.

"We will open up at a higher level, by implementing across the country a negative list for cross-border services trade and by exploring the development of national demonstration zones for the innovative development of trade in services," Chinese President Xi Jinping said in an address to the Global Trade in Services Summit of CIFTIS via video link on Thursday. "We will create more possibilities for cooperation by scaling up support for the growth of the services sector in Belt and Road partner countries and by sharing China's technological achievements with the rest of the world," Xi said.

Rules will be further improved for the services sector "by supporting Beijing and other localities in piloting the alignment of domestic rules with the ones in high-standard international free trade agreements and in building demonstration zones of digital trade," he stressed.

"We will continue to support the innovation-driven development of small- and medium-sized enterprises (SMEs), by deepening the reform of the New Third Board (National Equities Exchange and Quotations) and setting up a Beijing Stock Exchange as the primary platform serving innovation-oriented SMEs," Xi announced.

The new stock exchange decision charted a clear course for improving the capital market's role in providing financial support for SMEs, an official with the China Securities Regulatory Commission said shortly after the announcement of the new bourse.

A capital market and professional development platform that suits China's national conditions and would effectively serve technically advanced SMEs will be created, putting in place a regulated, transparent, open, vigorous and resilient capital market, according to the securities regulator, who praised SMEs for being able to "achieve big things" as they play a significant part in driving economic growth, fostering sci-tech innovation and creating jobs.

The A-share market is currently composed of stocks traded on the Shanghai and Shenzhen bourses, while the National Equities Exchange and Quotations in Beijing, also known as the New Third Board, acts as an over-the-counter market.

Highlights of President Xi's speech at the Global Trade in Services Summit of CIFTIS. Graphic: GT