On special contract terms

According to the report, compared with their peers in the official credit market, Chinese lenders offer contracts containing more elaborate repayment safeguards as well as cross-default, cross-cancellation and stability clauses, which gives them an advantage over other creditors. This conclusion ignores the particular context of China's outward lending. To achieve sustainable development, developing countries need to fill a huge infrastructure gap. Since the early 20th century, the Chinese government and state-owned banks have provided a large amount of infrastructure loans to low-and middle-income countries.

However, as infrastructure investment and financing often involve substantial capital and increased risk, meeting the financing needs of developing countries has been a thorny issue. To ensure the safety of their sovereign loans, Chinese creditors have included commonly-accepted clauses such as cross default and cross cancellation in the contracts.

CDB is in essence a commercial bank. Compared to China Eximbank, it has a stronger need to manage credit and liquidity risks through contract terms and make use of credit enhancement instruments when lending to high-risk borrowers. Nevertheless, the text used in China's loan contracts is the one generally accepted by the market and the terms are consistent with the principles of fairness and balance of rights and obligations of parties concerned.

As the times change, China's presence in the international sovereign lending has become more significant. The international community needs to foster an objective view of China's overseas sovereign lending.

Taking the financing needs of receiving countries as the top priority, China does not hesitate to take risks that other lenders cannot or are unwilling to take. This requires Chinese financial institutions to improve risk control mechanisms.

Despite their dire need for financing in infrastructure and other fields, commercial loans to developing countries, especially infrastructure loans, have been limited for a long time. This has become a major challenge to the world economy. The main reason is that infrastructure investment and financing requires significant capital input and involve a longer payback period.

In the past two decades, China has provided a large amount of bilateral loans to developing countries through policy and commercial funds, giving them important financial support for growing the economy, creating jobs, improving infrastructure and promoting industrialization.

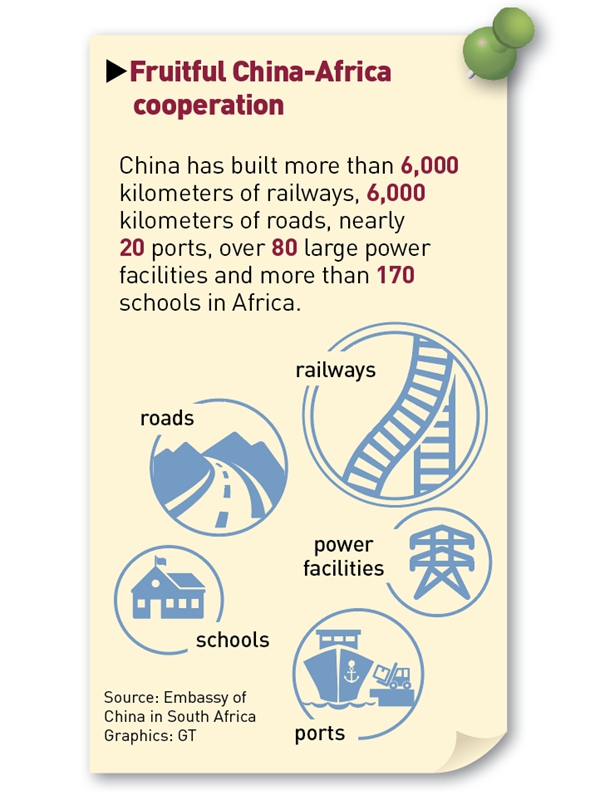

Source: Embassy of China in South Africa. Graphics: GT

And, policy loans provided through the bilateral channel is not a Chinese invention. Major Western countries all have similar official development financing institutions. The only difference is that these institutions have been on a decline. On the surface, such a decline is a manifestation of the budget constraints facing Western governments, but fundamentally, it is the result of liberal market ideology that makes livelihood projects a more likely beneficiary of ODA.As a result, infrastructure projects urgently needed by developing countries receive little attention: ODA providers are not capable of funding such projects, and commercial institutions also take no interest in them due to high risks. China's financing cooperation with other developing countries goes beyond the binary aid model of "government vs. market" of the West. It not only helps fill the funding gap, but also revolutionizes the concept of financing cooperation.

In terms of risk management and control methods, China explores replacing traditional means of ex-post dispute resolution with preventive measures taken before lending is provided. Such an approach encourages the debtor countries to become "responsible" borrowers in the process of development financing and increase their efforts toward sustainable development.

China's financing model, combining policy-based funds with commercial funds, represents the future of development financing. In recent years, new types of mixed loans with official and commercial institutions as joint lenders have increased in the global financing market.

That said, when providing development financing to developing countries, it is important to control and reduce investment risks and ensure security of capital. Therefore, China tries to replace traditional means of dispute resolution with contract tools that prevent default in sovereign loans. Combining the practices of commercial banks and official institutions, Chinese contracts aim to secure maximum repayment by adjusting the standard contract tools, including setting up a revenue account based on the proceeds of the project to provide additional funding for debt repayment and relieve the pressure on government budget.

It is a legitimate measure to ensure the capital safety of lenders and a commonly-accepted commercial practice. It is also a practice adopted by some OECD official creditors - as pointed out in the report, 7 percent of OECD official creditors sampled use repayment security devices.

Arrangements such as default clauses, to some extent, constrain the debtors to fulfill their obligations, which is the very purpose of signing a contract. It urges debtor countries to properly manage their debt and fulfill repayment responsibilities, and become "responsible" borrowers with international credibility, while enjoying convenient access to loan concessions. This helps to enhance the countries' reputation in the international development financing market and ultimately contributes to their economic and social sustainability.

(Huang Meibo and Niu Dongfang from Shanghai University of International Business and Economics.The views do not necessarily reflect those of this platform.)